How Are Corporations Taxed Twice . a c corporation (or c corp) is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the. how double taxation works. We explain double taxation and how to avoid it. when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the double taxation. When are c corp taxes due? a central issue relating to corporate taxation is the concept of double taxation. It can occur in three scenarios,. A corporation is the only type of business that must pay its own. It is most commonly used in reference to the combination of the corporate income. but how is it possible for a business to be taxed twice? in the united states, corporate income is taxed twice, once at the entity level and once at the shareholder level. if you own a business, the last thing you want is to get taxed on your income twice. double taxation occurs when income is taxed by two or more countries on the same profits. Certain corporations are taxed on. How are c corporations taxed?

from howtostartanllc.com

Congress reduced the highest rate of income tax on corporations from 35% to. double taxation on corporations. For corporations, the company is taxed as a business entity and each shareholder’s personal income is also. It can occur in three scenarios,. We explain double taxation and how to avoid it. corporations are taxed differently than other business structures: It is most commonly used in reference to the combination of the corporate income. How are c corporations taxed? How do c corps file taxes? double taxation occurs when income is taxed by two or more countries on the same profits.

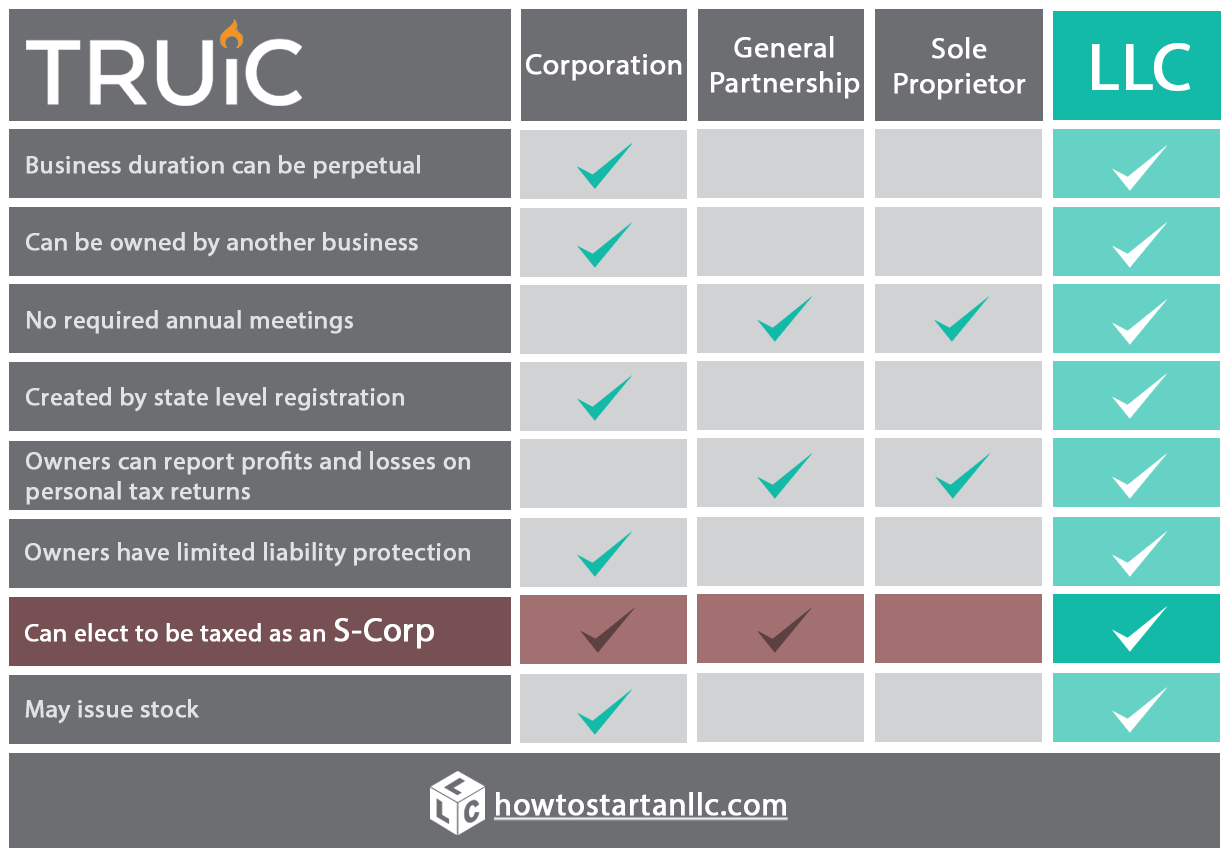

What is an LLC Limited Liability Company (LLC) TRUiC

How Are Corporations Taxed Twice How are c corporations taxed? We explain double taxation and how to avoid it. double taxing is the practice of taxing the same income stream twice. The term “double taxation” refers to. but how is it possible for a business to be taxed twice? How are c corporations taxed? when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the double taxation. a c corporation (or c corp) is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the. Businesses that are registered as c corps (and llcs that elect to be treated as corporations) are. Corporate earnings are taxed first as. double taxation occurs when the same income is taxed twice at different rates. double taxation occurs when income is taxed by two or more countries on the same profits. When are c corp taxes due? The double taxation of dividends is a reference to how corporate earnings and dividends are. a central issue relating to corporate taxation is the concept of double taxation. How do c corps file taxes?

From www.motherjones.com

The History of US Corporate Taxes In Four Colorful Charts Mother Jones How Are Corporations Taxed Twice if you own a business, the last thing you want is to get taxed on your income twice. When are c corp taxes due? Businesses that are registered as c corps (and llcs that elect to be treated as corporations) are. double taxation on corporations. Corporate earnings are taxed first as. double taxation occurs when the same. How Are Corporations Taxed Twice.

From slideplayer.com

to Federal Tax Business Entities ACNT 1347 Course How Are Corporations Taxed Twice double taxation refers to how corporations and their shareholders are taxed twice on earnings. It is most commonly used in reference to the combination of the corporate income. How do c corps file taxes? How can c corporations reduce their taxes?. when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the. How Are Corporations Taxed Twice.

From entrepreneur.com

States With the Lowest Corporate Tax Rates (Infographic) How Are Corporations Taxed Twice a c corporation (or c corp) is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the. The term “double taxation” refers to. Congress reduced the highest rate of income tax on corporations from 35% to. It is most commonly used in reference to the combination of the corporate income. but. How Are Corporations Taxed Twice.

From www.chegg.com

Solved Earnings of C corporations can be O A. taxed the How Are Corporations Taxed Twice When are c corp taxes due? how double taxation works. double taxing is the practice of taxing the same income stream twice. double taxation refers to the act of paying income taxes twice on the same income. a central issue relating to corporate taxation is the concept of double taxation. double taxation refers to the. How Are Corporations Taxed Twice.

From 24newsrecorder.com

How are companies taxed in different countries? 24 News Recorder How Are Corporations Taxed Twice but how is it possible for a business to be taxed twice? For corporations, the company is taxed as a business entity and each shareholder’s personal income is also. Certain corporations are taxed on. when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the double taxation. We explain double taxation and. How Are Corporations Taxed Twice.

From www.youtube.com

How are foreign corporations taxed on their U S Source YouTube How Are Corporations Taxed Twice Businesses that are registered as c corps (and llcs that elect to be treated as corporations) are. How are c corporations taxed? Congress reduced the highest rate of income tax on corporations from 35% to. It is most commonly used in reference to the combination of the corporate income. corporations are taxed differently than other business structures: if. How Are Corporations Taxed Twice.

From slideplayer.com

Business Organizations ppt download How Are Corporations Taxed Twice double taxing is the practice of taxing the same income stream twice. Certain corporations are taxed on. double taxation occurs when income is taxed by two or more countries on the same profits. but how is it possible for a business to be taxed twice? How can c corporations reduce their taxes?. When are c corp taxes. How Are Corporations Taxed Twice.

From www.stlouisfed.org

The Purpose and History of Taxes St. Louis Fed How Are Corporations Taxed Twice a c corporation (or c corp) is a legal structure for a corporation in which the owners, or shareholders, are taxed separately from the. The double taxation of dividends is a reference to how corporate earnings and dividends are. Congress reduced the highest rate of income tax on corporations from 35% to. double taxation occurs when income is. How Are Corporations Taxed Twice.

From slideplayer.com

Chapter 34 Corporations — Formation and Financing ppt download How Are Corporations Taxed Twice A corporation is the only type of business that must pay its own. The double taxation of dividends is a reference to how corporate earnings and dividends are. double taxation refers to the act of paying income taxes twice on the same income. double taxation on corporations. How can c corporations reduce their taxes?. corporations are taxed. How Are Corporations Taxed Twice.

From howtostartanllc.com

What is an LLC Limited Liability Company (LLC) TRUiC How Are Corporations Taxed Twice How do c corps file taxes? how double taxation works. How can c corporations reduce their taxes?. when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the double taxation. if you own a business, the last thing you want is to get taxed on your income twice. It can occur. How Are Corporations Taxed Twice.

From www.yourcompanyformations.co.uk

A Guide to Corporation Tax for your Company How Are Corporations Taxed Twice how double taxation works. double taxation refers to the act of paying income taxes twice on the same income. but how is it possible for a business to be taxed twice? double taxation occurs when the same income is taxed twice at different rates. double taxation refers to the income tax imposed twice on the. How Are Corporations Taxed Twice.

From slideplayer.com

Advanced Cooperative Taxation ppt download How Are Corporations Taxed Twice How are c corporations taxed? double taxing is the practice of taxing the same income stream twice. It is most commonly used in reference to the combination of the corporate income. double taxation on corporations. when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the double taxation. but how. How Are Corporations Taxed Twice.

From taxfoundation.org

Unequal Tax Treatment Contributing to Rising Debt Levels Entrepreneurs How Are Corporations Taxed Twice in the united states, corporate income is taxed twice, once at the entity level and once at the shareholder level. when taxpayers are taxed twice on the same income between two different jurisdictions, this falls under the double taxation. The double taxation of dividends is a reference to how corporate earnings and dividends are. It can occur in. How Are Corporations Taxed Twice.

From karnabelisabeth.pages.dev

When Are Business Taxes Due 2024 S Corp In India Winny Kariotta How Are Corporations Taxed Twice Certain corporations are taxed on. if you own a business, the last thing you want is to get taxed on your income twice. It is most commonly used in reference to the combination of the corporate income. in the united states, corporate income is taxed twice, once at the entity level and once at the shareholder level. The. How Are Corporations Taxed Twice.

From slideplayer.com

Corporations Paidin Capital and the Balance Sheet ppt download How Are Corporations Taxed Twice double taxation occurs when the same income is taxed twice at different rates. but how is it possible for a business to be taxed twice? Businesses that are registered as c corps (and llcs that elect to be treated as corporations) are. How are c corporations taxed? The term “double taxation” refers to. Congress reduced the highest rate. How Are Corporations Taxed Twice.

From www.youtube.com

3 Types of according to Robert Kiyosaki (Rich Dad Poor Dad How Are Corporations Taxed Twice how double taxation works. if you own a business, the last thing you want is to get taxed on your income twice. A corporation is the only type of business that must pay its own. When are c corp taxes due? How are c corporations taxed? a central issue relating to corporate taxation is the concept of. How Are Corporations Taxed Twice.

From kpmg.com

Why many insurance companies are being taxed twice KPMG Luxembourg How Are Corporations Taxed Twice It is most commonly used in reference to the combination of the corporate income. For corporations, the company is taxed as a business entity and each shareholder’s personal income is also. corporations are taxed differently than other business structures: double taxation refers to how corporations and their shareholders are taxed twice on earnings. The double taxation of dividends. How Are Corporations Taxed Twice.

From slideplayer.com

Sources of Government Revenue ppt download How Are Corporations Taxed Twice Corporate earnings are taxed first as. corporations are taxed differently than other business structures: How are c corporations taxed? How do c corps file taxes? How can c corporations reduce their taxes?. how double taxation works. The double taxation of dividends is a reference to how corporate earnings and dividends are. Businesses that are registered as c corps. How Are Corporations Taxed Twice.